Light Vehicle Batteries Market size to grow by USD 34.06 billion | Stringent Regulations on GHG Emissions from Automobiles as Key Driver | Technavio

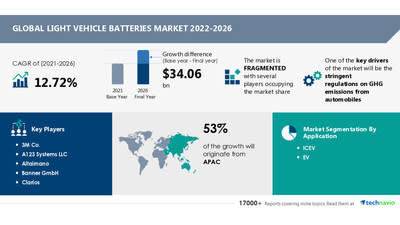

NEW YORK, March 3, 2022 /PRNewswire/ -- According to the research report "Light Vehicle Batteries Market by Application, and Geography - Forecast and Analysis 2022-2026", the market will witness a YOY growth of 10.47% in 2022 at a CAGR of 12.72% during the forecast period. The report is segmented by application (ICEV and EV) and geography (APAC, Europe, North America, South America, and the Middle East and Africa).

For more insights on YOY and CAGR, Read our FREE Sample Report

Vendor Insights

Global Light Vehicle Batteries is fragmented and the vendors are deploying various organic and inorganic growth strategies to compete in the market.

The growing competition in the market is compelling vendors to adopt various growth strategies such as promotional activities and spending on advertisements to improve the visibility of their services. Some vendors are also adopting inorganic growth strategies such as M&As to remain competitive in the market.

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

3M Co.

A123 Systems LLC

Altairnano

Banner GmbH

Clarios

EcoBat Battery Technologies

Exide Industries Ltd.

FIAMM Energy Technology Spa

Furukawa Electric Co. Ltd.

General Motors Co.

GS Yuasa Corp.

Johnson Matthey Plc

LG Chem Ltd.

Nissan Motor Co. Ltd.

Panasonic Corp.

Primearth EV Energy Co. Ltd.

Robert Bosch Stiftung GmbH

Find additional highlights on the growth strategies adopted by vendors and their product offerings, Read Free Sample Report.

Geographical Market Analysis

APAC will provide maximum growth opportunities in Light Vehicle Batteries during the forecast period. According to our research report, the region will contribute to 53% of the global market growth and is expected to dominate the market through 2026. China, Japan, and India are the key markets for the light vehicle batteries market in APAC. Market growth in this region will be faster than the growth of the market in other regions. The expansion of the light vehicle batteries market in APAC would be aided by rising economic standards over the forecast period.

Furthermore, countries such as the US, China, Japan, India, and Germany are expected to emerge as prominent markets for Light Vehicle Batteries during the forecast period.

Know more about this market's geographical distribution along with the detailed analysis of the top regions. https://www.technavio.com/report/light-vehicle-batteries-market-size-industry-analysis

Key Segment Analysis

The ICEV segment's market share of light vehicle batteries will expand significantly over the projection period. Because of the increased global production of passenger cars and light commercial vehicles, the ICEV segment of the global light vehicle batteries market is expected to develop at a moderate rate during the projected period. Automakers are developing more hybridized ICEVs in response to rising fuel economy standards and the trend toward electrification. In 2021, demand for passenger automobiles surged as more people planned to buy new and used cars. As a result, the market expansion will be fueled by increased demand over the forecast period.

View FREE Sample: to know additional highlights and key points on various market segments and their impact in coming years.

Key Market Drivers & Challenges:

One of the primary forces supporting the growth of the light vehicle batteries market is the strict limitations on GHG emissions from automobiles. The electricity and transportation industries in the United States account for more than half of all carbon pollution. As a result, the EPA and the NHTSA have collaborated to design standards to reduce GHG emissions and improve the fuel economy of passenger vehicles and trucks, with the goal of ensuring improved fuel savings, a cleaner environment, and fewer oil imports.

Another factor driving the growth of the light vehicle batteries market is the increasing number of vendor collaborations. Many suppliers are forming alliances in order to deliver innovative products and boost profits. This kind of collaboration also aids them in differentiating their products and remaining competitive in the market.

Download free sample for highlights on market Drivers & Challenges affecting the Light Vehicle Batteries market.

Customize Your Report

Don't miss out on the opportunity to speak to our analyst and know more insights about this market report. Our analysts can also help you customize this report according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time.

We offer USD 1,000 worth of FREE customization at the time of purchase. Speak to our Analyst now!

Related Reports:

Concentrating Solar Collectors Market by End-user and Geography - Forecast and Analysis 2022-2026

Solar Power Market in India by End-user and Application - Forecast and Analysis 2022-2026

Light Vehicle Batteries Market Scope

Report Coverage

Details

Page number

120

Base year

2021

Forecast period

2022-2026

Growth momentum & CAGR

Accelerate at a CAGR of 12.72%

Market growth 2022-2026

$ 34.06 billion

Market structure

Fragmented

YoY growth (%)

10.47

Regional analysis

APAC, Europe, North America, South America, and Middle East and Africa

Performing market contribution

APAC at 53%

Key consumer countries

US, China, Japan, India, and Germany

Competitive landscape

Leading companies, Competitive strategies, Consumer engagement scope

Key companies profiled

3M Co., A123 Systems LLC, Altairnano, Banner GmbH, Clarios, EcoBat Battery Technologies, Exide Industries Ltd., FIAMM Energy Technology Spa, Furukawa Electric Co. Ltd., General Motors Co., GS Yuasa Corp., Johnson Matthey Plc, LG Chem Ltd., Nissan Motor Co. Ltd., Panasonic Corp., Primearth EV Energy Co. Ltd., Robert Bosch Stiftung GmbH, Samsung SDI Co. Ltd., Suzuki Motor Corp., The BYD Motors Inc., and Toshiba Corp.

Market dynamics

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period

Customization purview

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized.

Table of Contents

1 Executive Summary

1.1 Market overview

2 Market Landscape

2.1 Market ecosystem

3 Market Sizing

3.1 Market definition

3.2 Market segment analysis

3.3 Market size 2021

3.4 Market outlook: Forecast for 2021-2026

4 Five Forces Analysis

4.1 Five forces summary

4.2 Bargaining power of buyers

4.3 Bargaining power of suppliers

4.4 Threat of new entrants

4.5 Threat of substitutes

4.6 Threat of rivalry

4.7 Market condition

5 Market Segmentation by Application

5.1 Market segments

5.2 Comparison by Application

5.3 ICEV - Market size and forecast 2021-2026

5.4 EV - Market size and forecast 2021-2026

5.5 Market opportunity by Application

6 Customer Landscape

6.1 Customer landscape overview

7 Geographic Landscape

7.1 Geographic segmentation

7.2 Geographic comparison

7.3 APAC - Market size and forecast 2021-2026

7.4 Europe - Market size and forecast 2021-2026

7.5 North America - Market size and forecast 2021-2026

7.6 South America - Market size and forecast 2021-2026

7.7 Middle East and Africa - Market size and forecast 2021-2026

7.8 China - Market size and forecast 2021-2026

7.9 US - Market size and forecast 2021-2026

7.10 Japan - Market size and forecast 2021-2026

7.11 Germany - Market size and forecast 2021-2026

7.12 India - Market size and forecast 2021-2026

7.13 Market opportunity by geography

8 Drivers, Challenges, and Trends

8.1 Market drivers

8.2 Market challenges

8.3 Impact of drivers and challenges

8.4 Market trends

9 Vendor Landscape

9.1 Overview

9.2 Vendor landscape

9.3 Landscape disruption

9.4 Industry risks

10 Vendor Analysis

10.1 Vendors covered

10.2 Market positioning of vendors

10.3 3M Co.

10.4 A123 Systems LLC

10.5 Altairnano

10.6 Banner GmbH

10.7 Clarios

10.8 Exide Industries Ltd.

10.9 GS Yuasa Corp.

10.10 LG Chem Ltd.

10.11 Samsung SDI Co. Ltd.

10.12 The BYD Motors Inc.

11 Appendix

11.1 Scope of the report

11.2 Inclusions and exclusions checklist

11.3 Currency conversion rates for US$

11.4 Research methodology

11.5 List of abbreviations

About Us:

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact Technavio Research Jesse Maida Media & Marketing Executive US: +1 844 364 1100 UK: +44 203 893 3200 Email: media@technavio.com Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/light-vehicle-batteries-market-size-to-grow-by-usd-34-06-billion--stringent-regulations-on-ghg-emissions-from-automobiles-as-key-driver--technavio-301494162.html

SOURCE Technavio

TRENDING

Don't want to tell the IRS about your jackpot from the casinos? You may not have to (which Caesars, MGM, and others should love).

As Nvidia's (NASDAQ: NVDA) Graphics Technology Conference 2022 (GTC 2022) approached its close on Wednesday, investors seemed largely unimpressed with the semiconductor giant's announcements. Nvidia's promise to enhance its artificial intelligence offerings, create a supercomputer for advanced robotics, expand its virtual reality Omniverse, and so on were all impressive announcements in and of themselves. It's just that they were largely expected, already "priced in" to the stock, and thus failed to convince Wall Street investors to shift their price targets.

Yahoo Finance Live looks at several of today's trending stock tickers.

Putin is insisting that the US, the UK and the EU pay for their Russian gas purchases with rubles—a strategy to force the West to dilute the effects of its own sanctions on Moscow.

Shares of autonomous vacuum-cleaner company iRobot (NASDAQ: IRBT) suddenly soared this morning, and as of noon ET on Thursday, the stock was up 10%. During the administration of President Donald Trump, the U.S. and China exchanged escalating tariffs on certain products. In 2021, iRobot paid over $48 million in tariffs, a huge number for small-cap company with a market capitalization under $1.8 billion.

Nvidia CEO Jensen Huang says the recent hack by Lapsus$ was a 'wake-up call' for the chip maker.

Driving higher yesterday, shares of Nio (NYSE: NIO) are reversing course and headed south today. Although the Chinese electric vehicle (EV) manufacturer hasn't reported any news to spur the stock's sell-off, investors are reacting to some pessimism from Wall Street. As of 10:49 a.m. ET, shares of Nio have dropped 4.5%.

For investors seeking a clear market signal, the last few weeks have been frustrating at best. So far this year, the main stock indexes are down – the S&P 500 has fallen just over 7%, while the NASDAQ is still in correction territory, with a 12% year-to-date loss. However, the market bounced back starting last week. We saw a week of solid gains that saw stocks make a strong rebound from their low points. The result: for the month of March, the S&P is up 3.9%, while the NASDAQ has gained 3.3%. Th

A Boeing 737-800 with 132 people on board crashed in southern China on Monday. Investors should keep a close eye on developments.

Warren Buffett is undeniably the most closely watched, highest-profile investor in modern history. Not surprisingly, investors relentlessly clamor to match his success by analyzing his portfolio, hoping to absorb even a tiny morsel of Buffett's investment genius. Despite his unparalleled success, Buffett's investment model has always been transparent, straightforward, and consistent.

Nikola (NKLA) investors finally have something to cheer about. On Wednesday, at the company’s Analyst Day, the EV truck startup announced that, as planned, production of the Tre battery electric truck had begun at the Coolidge, Arizona manufacturing facility on March 21. The company also said it expects to deliver 300 to 500 Tre semi-trucks this year and that by mid-2023, manufacturing for the European market will go ahead at the German facility. J.P. Morgan’s Bill Peterson attended the event, w

Yahoo Finance Live's Julie Hyman breaks down how MOEX, Russia's stock market, performed in its first limited trading session in nearly a month.

BiondVax Pharmaceuticals Ltd (NASDAQ: BVXV) has signed definitive agreements with the Max Planck Society and the University Medical Center Göttingen (UMG), both in Germany, for strategic collaboration to develop nanosized antibodies (NanoAbs). BiondVax will have an exclusive option for an exclusive worldwide license at pre-agreed commercial terms for further development and commercialization of each generated NanoAb. The NanoAbs previously developed by BiondVax's collaborators exhibit several ad

Seven in eight workers to pay more tax before next election Rishi Sunak holds back £32bn war chest amid economic uncertainty FTSE 100 edges 0.1pc higher; Pound falls against dollar Ben Marlow: Time to boycott Western companies still operating in Russia Sign up here for our daily business briefing newsletter

(Bloomberg) -- Russia’s highly regarded central bank Governor Elvira Nabiullina sought to resign after Vladimir Putin ordered an invasion of Ukraine, only to be told by the president to stay, according to four people with knowledge of the discussions.Most Read from BloombergPutin Adviser Chubais Quits Over Ukraine War, Leaves RussiaChina Plane Crash Update: Search Expanded; Calls to Flight CrewWhere Mornings Would Get Darker Under Permanent Daylight Savings TimeChina Jet’s Nosedive From 29,000 F

(Bloomberg) -- Against all odds and despite sanctions, Russian tycoons are regaining some of their wealth.Most Read from BloombergPutin Adviser Chubais Quits Over Ukraine War, Leaves RussiaChina Plane Crash Update: Searchers Identify Parts of WreckageRussia Central Banker Wanted Out Over Ukraine, Putin Said NoWall Street Is Scrambling For the Exits in Moscow — and Billions Are at StakeChina Jet’s Dive Took It Near Speed of Sound Before CrashAfter almost one month of suspension, shares in Moscow

“In the past few months we’ve already started seeing increases to the interest rates that banks are offering on deposit accounts, but it’s likely that we’ll see even more now that the Fed has announced a rate hike,” says Chanelle Bessette, banking specialist at Nerdwallet. Adds Ken Tumin, founder of DepositAcounts.com: “Several online banks have recently increased their savings account rates in the last two months, even before the first Fed rate hike,” adds Ken Tumin, founder of DepositAcounts.com — with potentially more increases to come, pros say.

EVgo (EVGO) shares have significantly outpaced the market so far in 2022, showing year-to-date gains of 20% vs. the S&P 500’s 6% downturn. Following the DCFC (DC fast charging) leader’s latest quarterly report, Evercore’s James West thinks the stock still has plenty of room to run. That said, 4Q21’s earnings were not an all-out success, with decent growth offset by bigger losses than anticipated. Specifically, the company generated revenue of $7.1 million, showing a 70% year-over-year uptick vs.

Two of the top healthcare companies you can invest in today are CVS Health (NYSE: CVS) and Walgreens Boots Alliance (NASDAQ: WBA). Are you better off going with Walgreens' more focused approach or that of CVS, with its broader, more diverse business model? One of the most attractive features about Walgreens, particularly for income investors, is its high yield, which at 4% far exceeds the 2% payout that CVS offers and the S&P 500 average's 1.3% yield.

(Bloomberg) -- Nvidia Corp., one of the largest buyers of outsourced chip production, said it will explore using Intel Corp. as a possible manufacturer of its products, but said Intel’s journey to becoming a foundry will be difficult. Most Read from BloombergPutin Adviser Chubais Quits Over Ukraine War, Leaves RussiaChina Plane Crash Update: Searchers Identify Parts of WreckageRussia Central Banker Wanted Out Over Ukraine, Putin Said NoWall Street Is Scrambling For the Exits in Moscow — and Bill

Source: https://finance.yahoo.com/news/light-vehicle-batteries-market-size-093000007.html

Comments

Post a Comment